|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Notes of JFU CPA, Tax Advisors, and Digital Tools are prepared for sharing our thoughts on problems encountered in the course of our practice. Subscription is free. Questions and comments are welcome; feel free to write to the Editor, JFU Notes, enquiries@jfuconsultants.com Hong Kong's Proposed Tax Law Presents a Golden Opportunity

Source : JFU

5 December 2022

The Inland Revenue (Amendment) (Taxation on Specified Foreign-sourced Income) Bill 2022 will likely to be passed into law and become effective early next year. The proposed law seeks to tax specified foreign-sourced income (“SFSI”) otherwise exempt from tax under Hong Kong’s long established territorial based system of taxation, currently referred to as foreign-sourced income exemption (“FSIE”) regime.

Hong Kong’s FSIE regime To put the proposal in context, one should bear in mind that Hong Kong has never been a sovereign state but instead a special administrative region of China and hence Hong Kong has no jurisdiction over activities outside her territories. Furthermore, over the years, Hong Kong has the benefit of an efficient administration, a relatively small government, and a highly productive economy. Together, this allows Hong Kong to be a low tax jurisdiction while generating sufficient revenue to meet demanding public expenditures and retaining a comfortable balance of fiscal reserve. Hong Kong’s FSIE regime is therefore a natural consequence of her historical developments and mode of administration. That said, it is natural that corporate tax strategies aiming at lowering effective tax rates often capitalize on Hong Kong’s low tax environment among other advantages that Hong Kong offers. However, there have been concerns that such tax strategies may involve abusive practices employed to shift income to Hong Kong without corresponding movement of underlying factors of production. As most jurisdictions form their tax bases on factors of production (wage and profit as rewards for labor and capital), such shifts result in a problem known as base erosion and profit shifting (“BEPS”): that is, exploiting economic resources in one jurisdiction without rewarding said jurisdiction with appropriate income and hence tax revenue. BEPS is therefore essentially a misalignment problem. It should be dealt with by requiring fair matching of factors used in production (economic substance) and income produced (tax base). Where tax preferential treatment is warranted in particular circumstances such as for development needs, a jurisdiction should only give preferential tax treatment to income with explicit link to real activities in its own territory.

Proposed modifications The proposed law is Hong Kong's response to international concerns over BEPS. The proposal is to modify Hong Kong’s FSIE regime by bringing into the scope of tax charge four types of SFSI received by an entity (“MNE entity”) acting for or belonging to a multinational enterprise group, viz.:

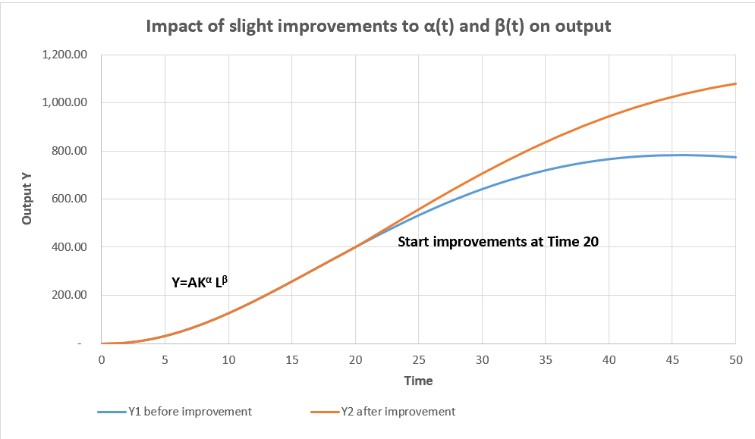

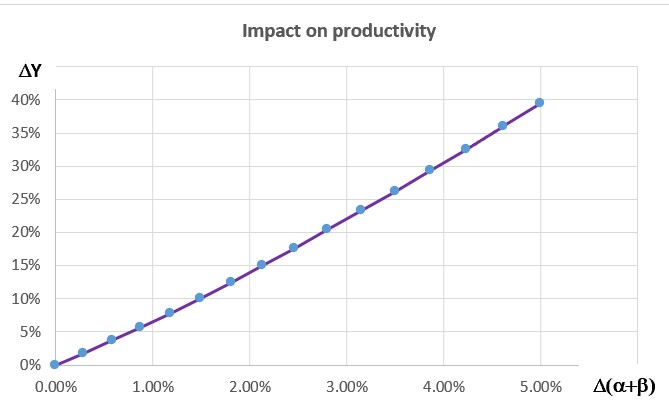

The proposed modifications will be implemented by enacting provisions to deem the SFSI as taxable income unless excepted. The proposal will not affect other types of foreign-sourced income such as manufacturing, trading or service income, and foreign-sourced income accruing to regulated financial institutions. Several exceptions will apply to exempt FSIE otherwise deemed chargeable. First, interest, dividend, and disposal gain satisfying the economic substance requirement will be exempt; second, dividend and disposal gain subject to minimum corporation income tax overseas can also be exempt on satisfying the participation requirement; and third, a fraction of the IP income otherwise deemed taxable can be exempt as excepted portion of qualifying IP income if the income is derived from patents or copyrights subsisting in software attributable to qualifying research and development expenditures. The condition for exemption is to ensure that there is sufficient nexus between the IP income and qualifying expenditures on the relevant IP asset as a proxy of substantial economic activities. However, such activities are not required to be carried out in Hong Kong, unless carried out by an associated person of the receiving MNE entity. What’s the opportunity Strictly speaking, the participation and nexus requirements as proposed are not introduced to deal with BEPS but to avoid causing inadvertent consequences in dealing with BEPS as the requirements do not require an explicit link between the exempt income and real activities in Hong Kong. Thus, MNE entities receiving exempt income in compliance with the participation or the nexus requirements are not required to bring substantial activities to Hong Kong. Yet we welcome having these requirements in Hong Kong’s FSIE regime because participation exemption has been an established mechanism to avoid double taxation on cross-border investments and the nexus requirement reflects the global consensus on using tax as a leverage to induce technological changes to promote productivity growth. As we see it, the real opportunity that the proposed law inspires lies in the new economic substance requirement under which specified economic activities are required to be performed in Hong Kong in order to obtain tax exemption of the relevant income. The scope of exempt income is currently limited to foreign-sourced interest, dividend, and disposal gain with the scope of the specified economic activities required to qualify for exemption also being quite limited. We would suggest that the scope of both the income and the income-producing activities should be slightly extended in order to open the door to an opportunity for Hong Kong to make a big difference to people in Hong Kong and probably the rest of the world. The proposed economic substance requirement The proposed law applies slightly different standards to a pure equity holding entity and a non-pure equity holding entity in determining if the entity has sufficient economic substance in Hong Kong. The economic substance requirement applicable to a pure equity holding entity is not onerous at all. The entity only has to comply with all the registration and filing requirements of the laws under which it is formed and also to hold and manage in Hong Kong its equity investments. The requirement applicable to a non-pure equity holding entity is slightly stretched to ensure that it also has in Hong Kong sufficient and appropriately qualified people, and resources to make strategic decisions and manage risks in dealing with what it holds. The gist of the requirement is that exempt income should be attributable to relevant factors employed and deployed in Hong Kong. The factors that the proposed law requires are qualified people, pertaining resources, and the specified economic activities being the exercise of strategic and risk management and the execution of transactions by those qualified people in Hong Kong. The required factors and the performance of the specified activities can be outsourced to third parties or related entities as long as the arrangement is commercially genuine and sufficiently monitored. What to offer What the proposed requirement affords is tax certainty as exempt income is matched to factors deployed in Hong Kong and hence should be free from risks of BEPS concerns. Hong Kong should however aspire to present a more substantive opportunity given her historical roles and challenges at this particular juncture of local and global developments. In contemplating what to offer, Hong Kong must be aware of her limitations that constrain extensive deployment of capital as the means of production and labor, i.e., the main factors of production. On the other hand, Hong Kong has acquired substantial professional capabilities for managing cross-border strategies and operations, owing to her role as a center of regional headquarters for international businesses for half a century. A big difference could be made if the proposed scope of specified economic activities can be slightly refocused. Refocusing policy aim to make a difference The graphs below depict the impact of a slight change in the efficiency of the factors of production (capital and labor) that Hong Kong is physically constrained to deploy. The graphs are based on the Cobb-Douglas production function which has been a source of insights for devising policies aiming at productivity growth. The function Y = AKαLβ depicts the relations between production Y of a firm or economy and factors K and L employed along with the use of a particular technology A. Exponents α and β indicates the efficiency of factors employed, with (α + β) = 1 representing a constant return, > 1 representing an increasing return, and < 1 representing a diminishing return. For illustration purposes, the choice of technology, proportion of factors used remain unchanged with only α and β slightly varying over time.

The impact is notable. Efficiency of the factors employed in production depends mainly on the quality of management that the underlying policy of the proposed tax law is aiming at. We applaud this policy aim but would venture to suggest that the policy aim should be slightly more ambitious. As it stands, the scope of the exempt income is limited to interest, dividend and disposal gain received by the holding entities and the scope of required substance or specified economic activities is limited mainly to management of equity or loan capital. If both scopes can be slightly stretched to encompass service income for activities performed in Hong Kong aiming at productivity growth of the overseas investees of the holding entities, the value thus created can potentially benefit the investees and the communities they belong. Yet the factors to be employed for producing that value are mainly management sciences and technologies together with experiences and knowhows that Hong Kong can employ virtually without physical constraints. Concluding remarks We applaud the proposed modifications to Hong Kong’s foreign-sourced income exemption regime, particularly the introduction of the economic substance requirement that, as explained, should be slightly finetuned to encompass activities aiming at productivity growth of the holding entities’ overseas investees. Management sciences and technologies, and professional expertise learnt from years of running international businesses allow Hong Kong to make a more substantive contribution to the global economy than tax certainty in addressing BEPS concerns. The expanded economic substance requirement will thus open the door to a golden opportunity of creating a new role for Hong Kong and for Hong Kong’s professionals irrespective of their specialty.

|

Please contact the authors for any comments or inquiries

Authors

|