|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Notes of JFU CPA, Tax Advisors, and Digital Tools are prepared for sharing our thoughts on problems encountered in the course of our practice. Subscription is free. Questions and comments are welcome; feel free to write to the Editor, JFU Notes, enquiries@jfuconsultants.com Tax for Growth

Tax Strategy for Maturing Growth Source : JFU

3 January 2025

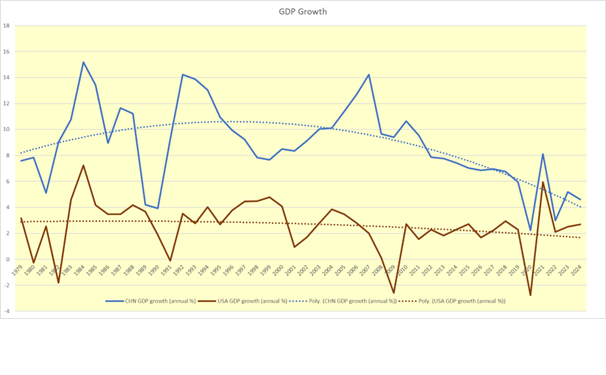

The Change in Context The following graph compares the GDP growth rates between the US and China over a period of 45 years, starting from 1979, the year when China decided to open up and integrate into the global economy. The graph shows that China’s economy has been maturing over the years, and its pattern of growth will have to align with that of a mature economy. Therefore, it needs to be perceived and managed as such. This implies that a reasonably healthy real growth rate for China should be somewhere between 2% and 4% under normal circumstances in the years to come. The nominal growth rate should be slightly higher, assuming a mild and healthy inflation rate can be maintained.

This change in context is crucial for planners. The policy planners clearly recognize this shift, as manifested in China's "Decision on Further Modernization" published in July 2024. Instead of insisting on maintaining a powerful economic growth engine, the planners now aim to advance Chinese civilization in both material and spiritual respects within 30 years, achieving harmony between humanity and nature—making China a thin place on earth. Bringing this bold vision to fruition requires equally courageous yet practical policy programs, inclusive participation, and proper motivation. As a professional firm based in Hong Kong with clients and collaboration partners in Mainland China and overseas, we would like to participate by offering thoughts to policy thinkers and working with the business communities.

Tax Thoughts The Musgrave Model, developed by Richard Musgrave, is a policy tool for studying how taxes impact economic activities, focusing on three primary functions of the government: allocation, distribution, and stabilization. It examines income for households and firms that provide the key factors of production (labour and capital). Income earned becomes funds available for the consumption of goods and services and savings for investments. Direct and indirect taxes fall at different points of the income flows and become funds for the government to produce public goods and services and administer laws and regulations.

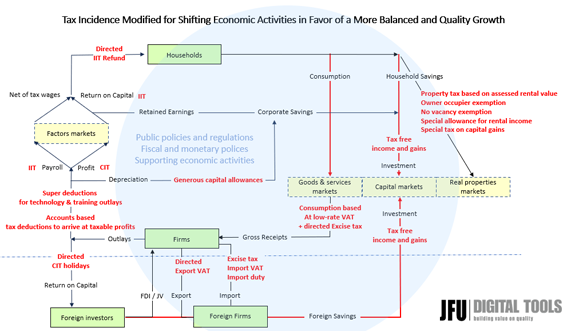

The diagram above is based on the Musgrave Model of tax incidence, modified for an open economy. Tax policy incentives shown in red are proposed to work along with income and profit, incentivizing households to work hard and firms to take risks. Targeted tax policies, along with income or profit as economic incentives, are intended to drive qualitative changes, by replacing rent-seeking behaviours as a source of motivation. In contrast, fiscal and monetary policies can play a more effective role in promoting equity in income distribution, encouraging fair resource allocation, and stabilizing economic fluctuations during challenging times.

Proposal Objectives Let us briefly discuss what the proposals are intended to achieve. First, the property tax proposal aims to redirect household savings from real properties to capital market investments, supported by a tax policy that provides tax-free income or gains from such investments. For effective capital market operation, tax policy alone is insufficient, but it can complement other policy measures and legal imperatives to foster investors’ confidence in corporate players. Second, households are spending far less than they should. Consumption is welfare. Without spending, households in effect work to benefit those who are willing to spend. Thus, a lower general VAT plus directed excise tax on consumption can help achieve a more equitable state of economic welfare. Again, tax policy serves only as a supplement to other policy measures that can effectively address people’s concerns about real-live challenges in coping with problems for the young, the old, and the sick. Third, firms are the production powerhouse. Production provides income for the factors market, which in turn generates spending and savings. Firms must grow to achieve economic growth. Growth, however, should not be measured solely in quantitative terms such as the aggregation of value added as the base for GDP measurement. Instead, growth should be measured as a rise in value over time, taking into account risk, sustainability, performance variability, and credibility in general. Readers may refer to our previously shared Notes on this subject. The tax policies we advocate for firms are targeted at fostering technology-based productivity growth, a subject we will further explore later. Finally, we propose a couple of tax policies on administration. Tax reporting is essential for achieving transparency and fairness. The diagram shows two policy measures:

Through these measures, we aim to build a more equitable, transparent, and incentivizing tax system to support economic growth and social welfare. |

Please contact the authors for any comments or inquiries

Authors

|